The How, Why & What of Calculating Profit Per Employee for Financial Performance

Reading Time:

Lead the pack with the latest in strategic L&D every month— straight to your inbox.

SubscribeProfit per employee is all about calculating how efficient your workforce is.

It can be easy to confuse revenue per employee with profit per employee, but they’re two separate HR metrics calculating similar but ultimately different things. Understanding how much profit your organisation makes is a good way to gauge your company’s efficiency.

In this guide we’ll look at what profit per employee is, what factors influence it, and how you can measure and improve it.

What is profit per employee?

Profit per employee is an HR metric measuring your company’s net income compared to the size of your workforce. In other words, it calculates the amount of profit each individual employee brings into the business over a certain time period. Its main purpose is to measure how efficiently an organisation utilises its workforce to generate profit.

Profit per employee vs revenue per employee

Your profit per employee is not the same as your revenue per employee. Revenue is the total amount of income a company brings in through its operations. Therefore, revenue per employee is about how much revenue each employee generates.

On the other hand, profit, or net profit, is the income left after expenses and operating costs are accounted for. So, profit per employee is just the amount of net income generated by each employee, rather than revenue as a whole. You can think of it as calculating how much your business made back from its products and services, or your return on talent.

Do you need to calculate profit per employee?

Just like any other HR metric, profit per employee isn’t useful to measure on its own. Maybe your employees generate around $50,000 profit each, which sounds great—but further investigation shows your organisation is actually overstaffed. Or, let’s say it’s $15,000 each, but the business is a new start-up with only a handful of staff, and is earning more net profits than competitors of a similar age and size. You need to look at other metrics to see the full picture of your company’s efficiency and operating costs.

Another way it’s just like other HR metrics: You can’t use it as a one-off. One good year in profits could be just that: A good year. Instead, you need to track profit per employee over time to understand the real value employees bring. This way you can see:

- Average profit value brought in by full-time employees

- How average profit per employee has grown over time

- How well your company is performing compared to industry competitors

- Where there may be potential issues impacting net profit that need to be addressed.

It also helps in understanding whether your employee training initiatives are as effective as they could be. This is why here at Acorn, we’ve developed the first performance learning management system (PLMS) to guide learners step-by-step to master the role-specific capabilities that drive organisational performance. As business performance is closely tied to revenue and profit, a PLMS is crucial for empowering people to reach their full potentential as impact players.

The challenges of trying to increase profit per employee

It’s easy to tell employees to just “work harder” to increase your profit per employee ratio, but that’s not realistic in any sense. Improving your net income per employee is an ongoing process of training, supporting, and developing the business and its workforce to become more efficient in its processes. Of course, this comes with its challenges.

The biggest barrier to creating a higher profit per employee is having the right talent with the right capabilities to deliver on business outcomes. This means hiring, retaining, and training talented employees in the capabilities required for them to perform their jobs efficiently, all of which costs money. You can reduce costs by streamlining your recruitment process (think using a capability map to ensure you’re choosing candidates with relevant capabilities).

Companies that focus solely on generating the highest profits sacrifice employee well-being and make it hard for themselves to actually generate more profit, creating a vicious cycle of turnover and expenditure. The most important thing to remember when trying to raise profit per number of employees is to ensure you aren’t breaching any ethical considerations which can impact the organisation and its workers, leading to more costs in the long run. That’s ethical issues like:

- Overworking employees in the pursuit of increased productivity, leading to burnout, stress, low employee morale and employee turnover. This ultimately costs businesses more in recruitment, with the average US company spending $4,000 to hire new employees, reducing the company’s profit margins.

- Cutting employee benefits and compensation to reduce overhead can impact your brand reputation among customers and potential candidates, making it difficult to bring net income home to begin with. This is not only unethical, but depending on the benefits and compensation being cut, could even be illegal. Organisations need to ensure fair and equitable pay practices to reflect employee value.

- Paying unreasonably low wages, denying employees time to break, and not following safety regulations creates an unsafe and exploitative work environment, which can open your organisation up to legal repercussions. It decreases morale, job satisfaction, and employee performance, hindering organisations’ ability to profit.

How to calculate profit per employee

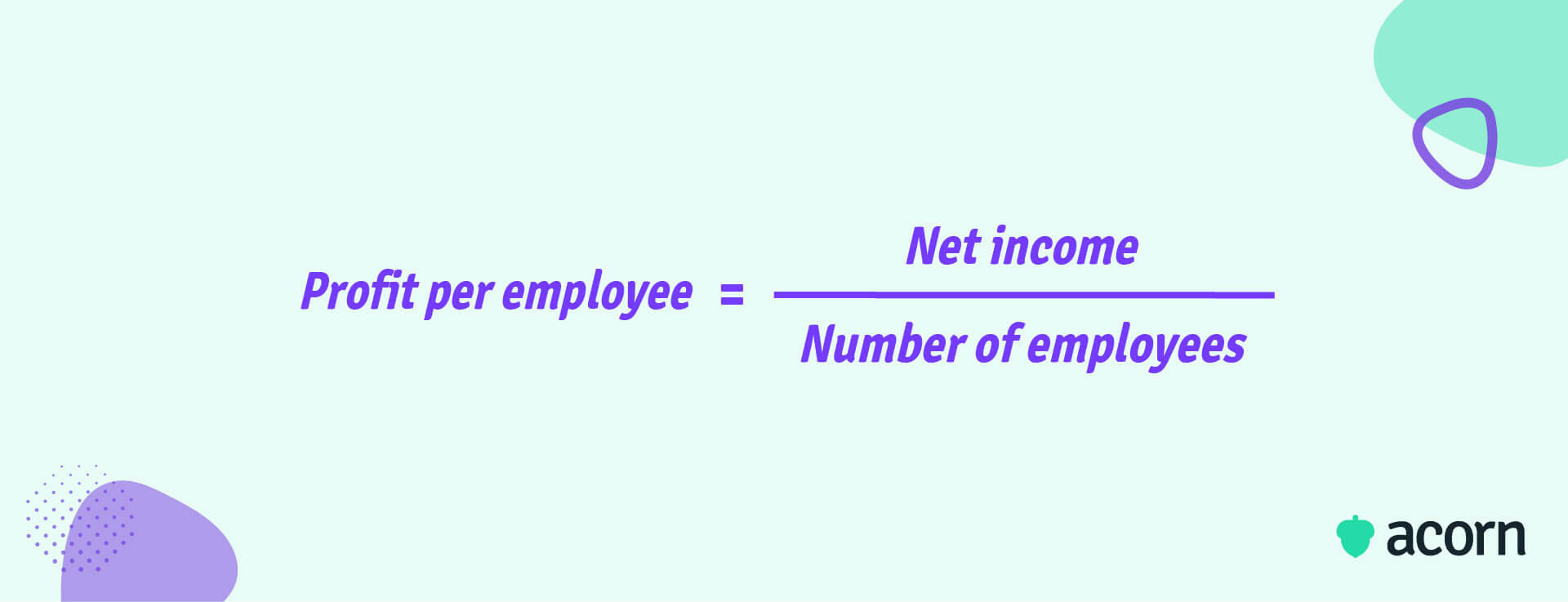

You can calculate net income per employee ratio by dividing your net income by the total number of employees at your organisation. So, your profit per employee formula is:

To calculate your total profit per employee, you need to know several things first:

- Your company’s total revenue over the chosen time period

- The total expenses of the organisation

- The total number of employees over said time period.

Once you calculate revenue and the total expenses over the time period, you can find your total profits by subtracting total expenses from total revenue. Total expenses are every cost related to running the business, from labour costs and overhead to operational costs. Let’s say that your net profits over a specific year are $1,000,000, and you had 50 employees during same period. Your profit per employee would look like this:

So, each employee generates average profits of $20,000 for that year.

What factors affect profit per employee?

Because your profit per employee is about how much profit is made after business expenses are accounted for, it goes without saying that profits are most affected by factors that increase (or decrease) organisational costs. Some of the common factors affecting profit per employee are:

- Industry. Just like you can’t go comparing revenue per full-time employees across different industries, you can’t compare net profits per employee either. Some industries tend to be a certain size in terms of headcount, and have particular programs and processes that need to be paid for. For this reason, profit per employee is used as a means of comparing different companies in the same industry.

- Company size. Organisations with fewer employees don’t have to spend as much on labour costs, increasing their net income. Plus, a combination of talent and performance management enables you keep talented employees while removing low-performers.

- Company age. Younger companies tend to have lower revenue, so their profit per employee ratio is going to be lower than that of older, established businesses.

- Learning and development initiatives. This is an inevitable expense, but done wrong it can be a costly one, cutting into potential profitability. It’s best to find your training ROI here to streamline and justify L&D spend for your business.

- Employee turnover. This is the big one. Companies with high turnover have to spend more on recruiting, hiring, and the onboarding process, increasing expenses that take away from gross income. Turnover also negatively impacts productivity and performance, generating lower revenue to start with.

6 ways to improve profit per employee

Now that we’ve covered the factors influencing profit per employee, let’s look at the strategies you can use to improve it. There are a few ways you can improve your profit per employee.

- Invest in technology that can automate processes, freeing up employees’ time to focus on other tasks and improve their productivity.

- Provide training and development to employees, upskilling and developing their capabilities to allow them to perform their job roles more efficiently. Build a culture of continuous learning to ensure continued improvement.

- Improve hiring and recruitment efforts, by finding candidates with the right skills (you can use a capability model to help here) to reduce time to proficiency and productivity.

- Foster a positive workplace culture with collaboration and teamwork to drive engagement and increase efficiency and productivity in the workplace.

- Focus on customer satisfaction to build your brand reputation, to build trust with customers. This will improve revenue, and your profits.

- Continuously calculate profit per employee (such as on an annual basis) to track whether average profit per employee has improved or not. This allows you to see historical changes and identify and address areas that need improvement, leading to growth (and making the company more profitable).

Key takeaways

Just like revenue per employee, profit per employee is another HR metric that should be used alongside others to get the full picture of how efficiently your workforce is performing. It’s about understanding the value of your workforce—specifically, the value brought to the business by each individual employee.

The important thing to remember is that, like revenue per employee, you need to measure profit per employee regularly. That way, you’ll see when your profits increase or decrease over time, indicating where there are problems that should be addressed to ensure better financial performance in the future.